The simple answer to the question is yes: you can invest borrowed money in stocks. It’s a risky strategy. It’s also quite popular, especially during bull markets. Some people have used it very effectively and made money. Others have lost, sometimes badly.

That’s the simple answer, but how do you go about doing it?

The decision to invest with borrowed money comes down to comparing the cost of borrowing versus the expected investment returns… If the returns exceed the cost, then the transaction makes economic sense.

How Can You Invest in Stocks With Borrowed Money?

There are several ways to invest in stocks with borrowed money. Here are the most important ones.

1. Margin Accounts

Many brokers will lend you money to buy stocks. This is called buying on margin, and you’ll need to open a margin account to do it. A margin account is different from a basic cash account, in which you can only purchase securities with the cash in your account.

You’ll have to apply for a margin account with your broker. You’ll need a minimum investment of $2000. When you buy stocks, you can borrow up to 50% of the purchase from the broker. You will have to pay the balance yourself. This enables you to make larger purchases than you otherwise could.

The money or securities in your account are collateral for the money you have borrowed. This collateral is called your margin. When you sell the securities bought on margin the broker will deduct the loaned amount, along with interest and any fees involved.

Know the Terms of Your Agreement

This process sounds straightforward, but it’s important to know the exact terms of your margin account. Here are some particular things to watch for.

- Restrictions. You won’t be able to buy penny stocks, OTCBB securities, or IPOs on margin.

- Interest. Margin loans carry interest, which may be substantial. If you hold stocks bought on margin for some time you will have to make periodic interest payments. For this reason, margin purchases are usually intended to be short term holdings.

- Fees. Many brokers impose fees for margin transactions. You’ll have to factor the fees into your calculations of cost and benefit.

- Maintenance Margins. This is the minimum balance you must keep in your account. If your balance is below this level you may have to deposit funds or sell stocks. You’ll need a maintenance margin of 25% of the account value or $2000, whichever is greater.

- Margin calls. If you fall below the maintenance margin (for example, if your stocks fall in value) your broker can issue a margin call, requiring you to deposit funds. If you don’t, the broker can sell securities at their discretion without your consent. Many margin agreements allow brokers to sell without warning you first.

Buying on margin can be profitable if your investment appreciates significantly in a short time period. If you have to hold the stocks for an extended period the interest charges may outweigh your profits. If the stocks that serve as your collateral drop in value, you may have to put up cash or sell your stocks at a loss.

A margin call is an issue that demands immediate attention. If you don’t deposit cash or sell stocks of your choosing your broker can sell whatever they like to cover the call. Because margin loans are callable, they are considered a high-risk method of investing.

2. Other Loans

Any loan that generates disposable cash can be used to buy stocks. Your broker won’t ask where you got the money you deposit in your account. You can use a personal loan, as long as the lender does not place any restriction on the use of the loan proceeds. You could use a home equity loan or any form of loan that does not require the proceeds to be used for a specific purpose.

These loans have one advantage over a margin loan: they are generally not callable. You will still have to pay the loan back, and unlike a margin loan, you’ll have to make regular payments.

⚠️ If your investments don’t appreciate as fast as you expected, you could miss payments. That could trash your credit, and if your loan is secured you may lose your collateral. Remember that you will be paying interest on the loan, and often fees as well.

3. Loans From Friends or Family

Many young investors borrow money from friends or family to start investing. This is the least financially risky form of loan: your relatives won’t report missed payments to a credit bureau, and unless you have a formal promissory note you won’t face legal action.

⚠️ You could still face serious damage to valued relationships.

If you do intend to borrow money from friends or family to invest in the stock market, be upfront with what you’re doing. Make sure the lender knows what you’re doing and understands the risk.

4. Indirect Loans

Many people borrow money to buy stocks without even knowing it. If you have an active loan and you choose to invest money rather than make extra loan payments, you are effectively using borrowed money to buy stocks.

👉 If you could afford to pay cash for a car but instead take out a loan and invest the rest of your money, you are indirectly using a loan to buy stocks.

Of course, this isn’t always a risky idea. The risk level depends on the type of loan you hold and the type of investment you’re making

👇If you’re making 401(k) contributions while you still hold a mortgage, you’re taking a very low risk.

👆 If you choose to put money into meme stocks or cryptocurrency instead of paying off high-interest credit card debt, your risk is a lot higher.Do People Borrow Money to Invest in Stocks?

Borrowing money to invest in stocks is popular and common. A survey revealed that 4 out of 10 surveyed investors had taken on debt to buy stocks. Some key points from the survey:

- Younger investors were more likely to take on debt. 80% of Gen Z investors, 60% of Millennials, 28% of Gen Xers and 9% of Boomers bought stocks with borrowed money.

- Personal loans were popular. 38% had taken personal loans to invest. 23% borrowed from friends or family. Others used credit card debt (14%), borrowed from a retirement plan (13%), or used home equity (11%).

- Many investors borrowed to fund retirement. 37% of those surveyed borrowed money to use in their retirement plan. 32% wanted to buy a particular stock, 31% were day trading. 10% bought cryptocurrency.

- Most would borrow again. 61% said they would borrow again to fund investments, 33% said they might consider borrowing again.

- Borrowings were substantial. Almost half of the borrowers took out loans of $5000 or more. 20% took over $10,000.

One notable point: the study did not include margin debt. That may be why Gen X and boomer investors were less likely to report borrowing. Older investors are more likely to qualify for margin accounts.

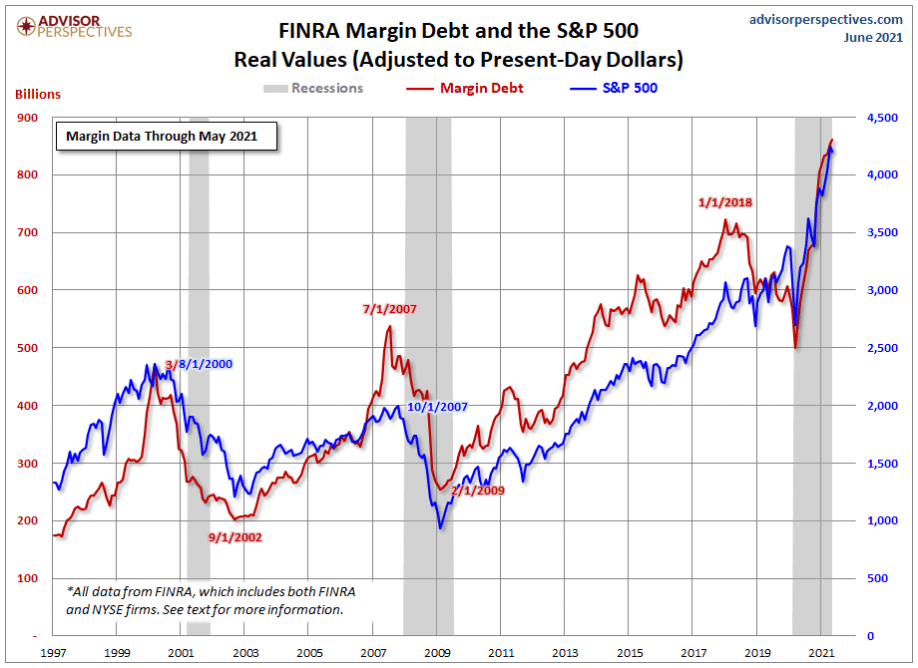

Margin trading is also considerable, and margin debt is currently at all-time highs.

Comments